ClosedLoop Gains Financial Insights, Delays FTE CFO Hire for 18 Months with Jirav

Total time it now takes to update critical financial reports and update the forecast

The amount of time spent looking for a FP&A solution, purpose built for growth companies, like Jirav

Developing a data science platform for the healthcare industry, ClosedLoop is a venture-funded, fast-growing startup. Using Jirav for its financial planning and analysis, the SaaS company successfully enhanced board collaboration and communication, improved scenario planning and strategy, and gained CFO capabilities without the overhead.

Challenge

Founded in 2017, ClosedLoop initially used Excel for its financial planning and analysis. That’s pretty common for startups, even though Excel-based models can be a hassle to build—let alone maintain and use. “Many of us startup founders swap financial model spreadsheets so that we don’t have to start ours from scratch,” said Andrew Eye, CEO and co-founder, ClosedLoop.

In its early stages, ClosedLoop hired a part-time CFO to handle the financial planning. That individual got hands-on with those financial spreadsheets and made sure the fragile balance of formulas and data remained intact. As the company grew, the leadership team tracked growth and explored what-if scenarios in those sheets—like any startup would.

What led ClosedLoop to look for a better financial modeling process than spreadsheets? “Our financial planning sheet was brittle—I was constantly terrified that someone would make a mistake in a cell and break everything,” said Eye. “It was also near impossible to compare scenarios. Comparing plan to actuals was a manual process that just can’t be done easily or effectively with Excel.”

The company hit a breaking point when the part-time CFO left. “I had to choose between hiring a full-time CFO to manage and manually update or model, or find a technology that could do that for me,” said Eye.

Challenges overcome

Excel based financial spreadsheets were brittle and risked error

Scenario comparison and testing was nearly impossible

Part-time CFO left making financial reporting and analysis even more challenging

Advantages delivered

Delayed need to hire CFO 18 months

Enhanced board collaboration and communication

Achieved full time to value in 60 days

Reduced time to produce critical reports and update the forecast to 10 minutes

Our financial planning sheet was brittle—I was constantly terrified that someone would make a mistake in a cell and break everything. It was also near impossible to compare scenarios. Comparing plan to actuals was a manual process that just can’t be done easily or effectively with Excel.”

ClosedLoop

Solution

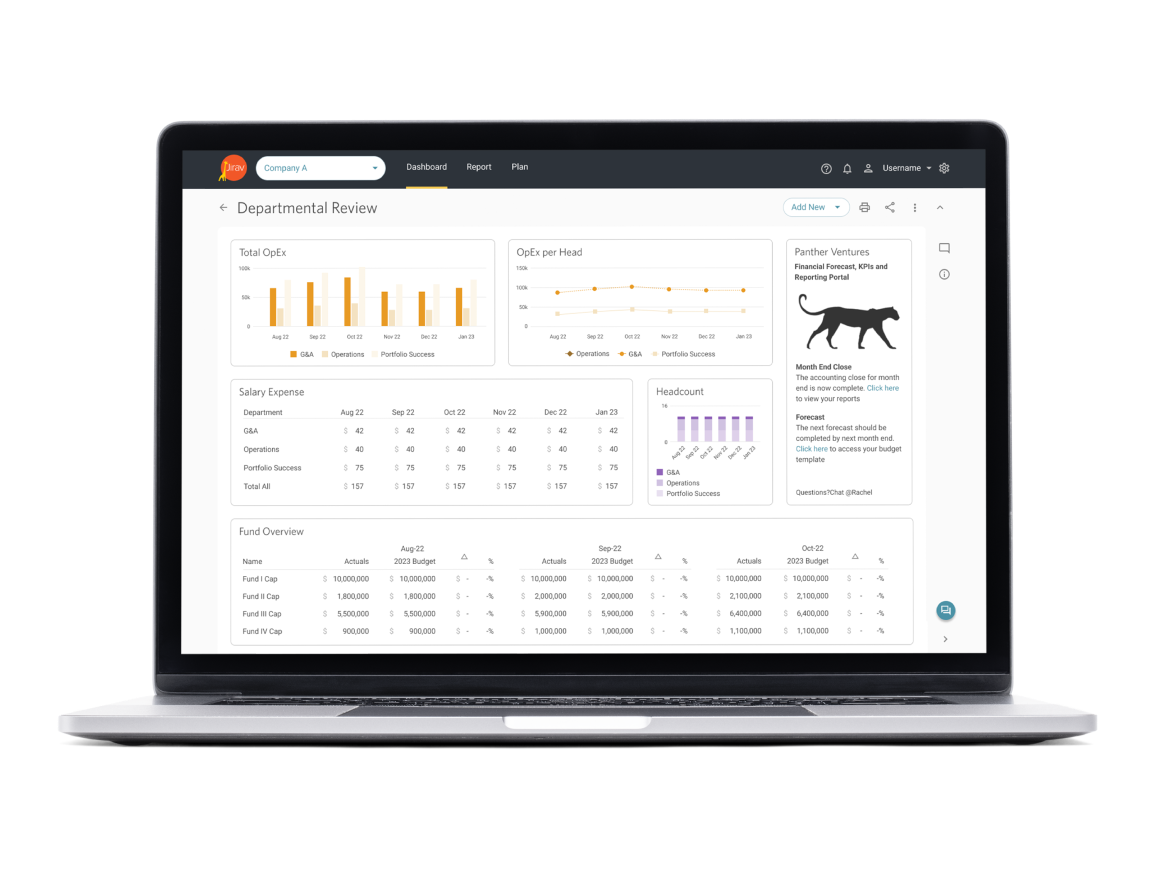

Looking to put off the full-time CFO hire, Eye found Jirav stood out as an FP&A solution for fast-moving companies like ClosedLoop. “A big part of why we chose Jirav is the drivers engine. Jirav gives us the flexibility of a spreadsheet with the reliability of actual software,” said Eye. It also integrated with their QuickBooks software.

Results

Jirav partnered with ClosedLoop to provide fast value. The Jirav team built the initial financial model within 60 days--in time to share with board members at the company’s quarterly meeting. Jirav is now a regular part of board communications,facilitating strategy discussions and allowing an easy way to explore options and scenarios. It’s now central to ClosedLoop’s financial planning and analysis for forecasting, budget tracking, cashflow forecasting and investor relations. “We use Jirav in our quarterly board meetings. Investors have their own logins, and they love the reporting it provides,” said Eye.

Cashflow forecasting in particular has value for ClosedLoop.“With Jirav we can build assumptions in any way we want, anywhere throughout our model,” said Eye. “We use Jirav’s drivers to model the effects of changes for everything from staffing to revenue projections.”

Not only does ClosedLoop use Jirav to save time on highly manual data processes, the company is able to do things it couldn’t do before. “We didn’t have a pro forma forecast--we’d do it maybe once a year, and play with the assumptions. If you don’t have a full-time CFO, it was too time-consuming without Jirav--even though that information is crucial to decision-making in a company’s early stages.”

He added: “I’ve been looking for this software for ten years, across multiple different startups. I wanted FP&A for growth companies that can integrate with QuickBooks and analyze plan versus actuals. Jirav does what a growth company needs.”

In fact, Eye says that just about every company working with venture capital would benefit from Jirav. He sums it up this way: “Using Jirav helped me delay hiring a full time CFO for 18 months. When you’re a Series A company, most of what the CEO needs is to update the forecast and see how we perform against plan. Now I can do all that in ten minutes in Jirav.”

Let’s get started!

I’ve been looking for this software for ten years, across multiple different startups. I wanted FP&A for growth companies that can integrate with QuickBooks and analyze plan versus actuals. Jirav does what a growth company needs

ClosedLoop